How Digital Assets Are Entering Everyday Spending

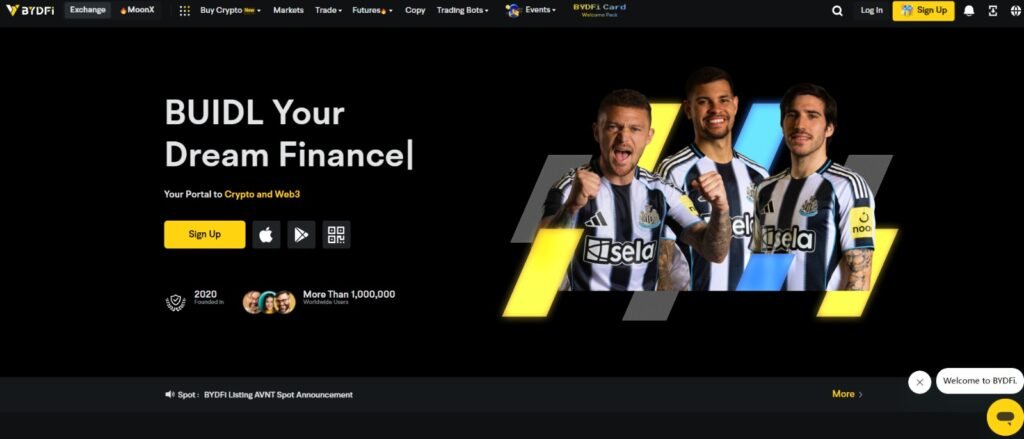

In the modern era of digital transformation, the way we interact with money is undergoing a major shift. The rise of digital assets, such as cryptocurrencies and digital currencies, is reshaping the landscape of everyday spending. Traditional forms of payment like cash, credit cards, and even mobile wallets are being supplemented—and in some cases, replaced—by digital assets. A key factor in this revolution is the increasing use of digital assets in day-to-day purchases. Tools like the BYDFi Card are helping bridge the gap between digital currencies and the real-world economy, making it easier than ever to spend crypto assets in everyday transactions.

Understanding Digital Assets

Digital assets refer to any form of content or value that exists in digital form. While this term covers a broad spectrum of goods such as digital art, music, or documents, in the context of spending, digital assets are primarily cryptocurrencies like Bitcoin, Ethereum, and newer digital currencies. Cryptocurrencies, unlike traditional fiat money, are decentralized and are based on blockchain technology, allowing for peer-to-peer transactions that bypass traditional financial institutions. This opens up new opportunities for spending, investing, and saving, all powered by digital assets.

The Growth of Digital Assets in Spending

The idea of using digital currencies in daily life was once considered far-fetched, but rapid advancements in technology and growing interest in cryptocurrency have propelled digital assets into the mainstream. As the adoption of digital currencies increases, more businesses, retailers, and service providers are accepting these alternative payment methods.

For example, many online platforms, especially in tech and gaming, have been at the forefront of embracing digital currencies. But now, brick-and-mortar stores, coffee shops, and even restaurants are starting to accept digital assets for goods and services. The BYDFi Card, for instance, allows users to link their digital asset holdings to a physical card that works just like a traditional debit card. This integration helps facilitate transactions in cryptocurrencies, making it possible to use digital assets in everyday spending without requiring merchants to directly accept cryptocurrency.

How the BYDFi Card Revolutionizes Spending

The BYDFi Card is a prime example of how digital assets are becoming more accessible for everyday spending. This card acts as a bridge between the decentralized world of cryptocurrencies and the traditional financial system. When a user holds digital assets in their crypto wallet, they can convert these assets into local currency through the BYDFi Card. This card works like a prepaid debit card, allowing the user to pay with cryptocurrency while the payment is processed in fiat currency. With its easy integration into existing payment systems, the BYDFi Card removes the barriers that once limited the use of digital assets in everyday life.

One of the primary advantages of the BYDFi Card is that it allows users to spend digital assets without needing to worry about finding businesses that accept cryptocurrencies directly. For instance, while Bitcoin may be accepted by some online platforms, most retail outlets and service providers still primarily deal in fiat money. The BYDFi Card solves this issue by enabling cryptocurrency holders to spend their digital assets at any location that accepts traditional card payments. This flexibility is crucial in driving the adoption of digital assets in daily spending habits.

Benefits of Using Digital Assets for Everyday Spending

- Increased Privacy: Digital assets provide a higher level of privacy compared to traditional payment methods. When using cash or credit cards, your transactions are often tracked by banks and financial institutions. With cryptocurrencies, users have more control over their financial privacy, especially when using cards like the BYDFi Card, which operates in a decentralized manner.

- Global Accessibility: Cryptocurrencies are not bound by geographical borders. This means that regardless of your location, you can use your digital assets for transactions across the globe. Whether you’re traveling internationally or purchasing from a foreign vendor, digital assets like Bitcoin and Ethereum can be seamlessly used via tools like the BYDFi Card.

- Reduced Fees: One of the major challenges of traditional payment systems is the high transaction fees. International money transfers, for example, often come with hefty charges. Digital assets, on the other hand, generally offer lower transaction costs, especially when using the BYDFi Card to facilitate payments. Users can avoid the significant fees imposed by banks and payment processors.

- Faster Transactions: Traditional payment methods often involve delays, especially with international transfers. In contrast, digital asset transactions—powered by blockchain technology—are typically faster and more efficient, providing a smooth user experience when paying through the BYDFi Card.

- Security and Transparency: Blockchain technology ensures that every transaction is securely recorded and verified. This level of transparency and security makes digital assets a compelling alternative to traditional payment methods. When using a BYDFi Card, users can enjoy the peace of mind that comes with the secure and transparent nature of cryptocurrency transactions.

The Future of Digital Assets in Everyday Life

As digital assets continue to gain traction, it’s expected that they will play an even greater role in the global economy. Businesses, both big and small, are increasingly adopting digital asset payment options, and cryptocurrencies are becoming more stable and user-friendly. The BYDFi Card is just one example of how this shift is happening, providing consumers with the tools to seamlessly integrate digital assets into their everyday spending habits.

In the future, it’s likely that we’ll see more innovation in digital asset payment systems. As more merchants begin to accept cryptocurrencies and digital currencies become more stable, spending digital assets will become as commonplace as using a credit card or mobile wallet. The key to this widespread adoption will lie in making digital assets more accessible, easier to use, and more integrated into existing payment systems. The BYDFi Card is helping make this a reality by offering a convenient, secure, and efficient way for consumers to spend their digital assets.

Challenges and Barriers to Adoption

While the potential for digital assets in everyday spending is undeniable, there are still challenges that need to be addressed. The volatility of cryptocurrencies, for instance, can deter some people from using them for everyday transactions. The BYDFi Card helps to mitigate some of these risks by offering users the option to convert their digital assets into stablecoins or fiat currency, reducing the effects of price fluctuations on purchases.

Moreover, regulatory uncertainty is another hurdle that digital asset adoption must overcome. Governments around the world are still grappling with how to regulate cryptocurrencies, and this uncertainty can create hesitation among consumers and businesses. However, as the regulatory landscape becomes clearer and more standardized, it’s expected that digital assets will become even more mainstream.

FAQs about How Digital Assets Are Entering Everyday Spending

1. What are digital assets?

Digital assets are any assets that exist in a digital format. In the context of spending, digital assets typically refer to cryptocurrencies such as Bitcoin, Ethereum, and other blockchain-based assets. These assets are decentralized and can be used for online and offline purchases, investments, and savings.

2. How does the BYDFi Card work?

The BYDFi Card is a prepaid card that allows users to link their cryptocurrency holdings to make everyday purchases. When you spend, the BYDFi Card converts your digital assets (like Bitcoin or Ethereum) into fiat currency, such as USD or EUR, and processes the payment through traditional payment networks, just like a debit or credit card.

3. Can I use the BYDFi Card at any store?

Yes, the BYDFi Card can be used anywhere that accepts traditional debit or credit cards. This includes both online and in-store purchases, giving users the flexibility to spend their digital assets in everyday transactions without needing merchants to directly accept cryptocurrency.

4. Are there any fees associated with using the BYDFi Card?

Yes, like most financial products, there may be fees associated with the BYDFi Card, such as transaction fees or foreign exchange fees when converting your digital assets into fiat currency. However, the fees are typically lower compared to traditional banking services, especially for international transactions.

5. How can I load my digital assets onto the BYDFi Card?

To load your digital assets onto the BYDFi Card, you first need to link your cryptocurrency wallet to the card’s associated platform. From there, you can transfer digital assets into the platform’s wallet, which can then be converted into fiat currency for use with the card.

6. Is it safe to use the BYDFi Card for everyday purchases?

Yes, the BYDFi Card employs secure encryption and safety protocols to ensure that your funds and personal data are protected. Additionally, because it is powered by blockchain technology, every transaction is transparent, traceable, and securely recorded.

7. What are the benefits of using digital assets for everyday spending?

Using digital assets for everyday spending offers several advantages:

- Global access: Digital currencies can be used across borders without the need for currency exchange.

- Reduced fees: Compared to traditional banking and payment systems, digital asset transactions generally incur lower fees.

- Privacy: Cryptocurrencies can provide more privacy compared to traditional payment methods.

- Security: Blockchain technology offers enhanced security and transparency for transactions.

8. Can I withdraw cash from an ATM using the BYDFi Card?

Yes, in most cases, the BYDFi Card allows you to withdraw cash from ATMs that accept debit card transactions. This feature provides flexibility for users who want to access cash from their digital asset holdings.

9. What happens if the value of my digital assets fluctuates?

Cryptocurrencies are known for their volatility, and the value of your digital assets can fluctuate significantly. However, the BYDFi Card allows you to convert your assets into stablecoins or fiat currency at the time of the transaction, helping to minimize the impact of these fluctuations on everyday purchases.

10. Will digital assets replace traditional payment methods in the future?

While digital assets are gaining popularity, traditional payment methods like credit cards and cash are unlikely to disappear anytime soon. However, digital assets are expected to play a significant role in the future of payments, especially as technologies like the BYDFi Card continue to bridge the gap between digital currencies and traditional financial systems.

Conclusion

Digital assets are making their way into everyday spending, transforming the way people pay for goods and services. With the rise of cryptocurrency adoption and payment solutions like the BYDFi Card, users are now able to seamlessly integrate digital currencies into their daily financial lives. The future looks promising for digital assets, and as the infrastructure around them continues to evolve, spending digital assets may soon be as easy and common as using traditional forms of payment. The BYDFi Card is just one example of how technology is making this transition smoother and more accessible, offering a glimpse of a world where digital assets are part of everyday life.